Shares of cannabis-linked companies rallied on Monday after President Donald Trump said he was considering reclassifying marijuana as a less dangerous drug — giving the sector a much needed boost.

The stock of greenhouse production firm Village Farms International Inc. surged as much as 42% on Monday, its biggest intraday jump since June 2017. Tilray Brands Inc., Canopy Growth Corp., Aurora Cannabis Inc., SNDL Inc. and Cronos Group Inc. all climbed by double digits after the US president told reporters at the White House on Monday that he was looking at making the change over “the next few weeks.”

The Wall Street Journal first reported on Friday that Trump spoke on cannabis reclassification during a fundraising event, citing people familiar with the matter. A new scheduling from the administration could also reignite hope for a broader federal legislation push that is key to unlocking value in the sector.

Cannabis is currently labeled as a Schedule 1 drug — putting it into a category that also includes substances like heroin and LSD. Former Florida Republican representative Matt Gaetz said in a March op-ed that the Trump administration would bring “meaningful change” in reclassifying cannabis to a Schedule III drug, which puts it on the same level as anabolic steroids and the medication Adderall.

“Over the long-term, a rescheduling of cannabis would likely lift the entire sector by bolstering research, reducing stigma, improving access to capital, and opening up a large addressable market,” TD Cowen analyst Derek Lessard wrote in a Monday note.

He rates Canadian cannabis producer Aurora Cannabis a buy, but reminded investors the company has no known plans to enter the US market. Even if the US approved a rescheduling of marijuana’s status, it wouldn’t likely have near-term effects on companies without US operations, he warned.

Rescheduling is also a separate issue than federal legislation. The US operates as a state patchwork system as far as legalization goes and progress on legalizing marijuana on a federal level has been slow. The sector trades well below its 2021 heyday, when rates were lower and investor enthusiasm was at its peak.

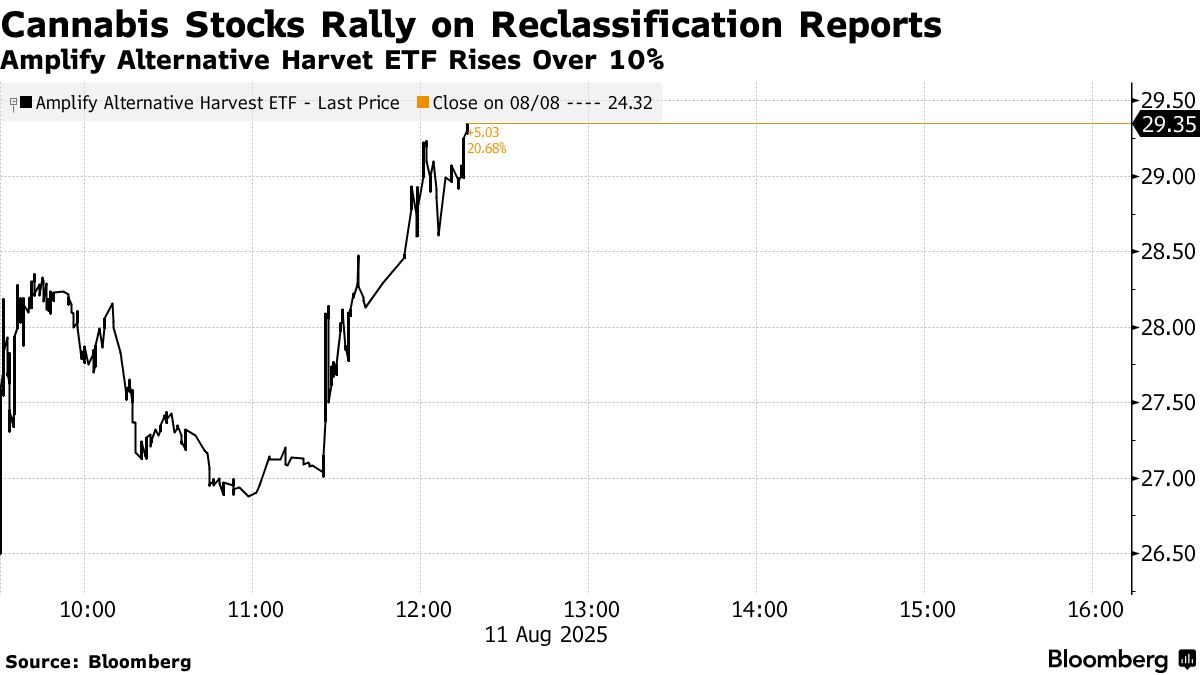

The Amplify Alternative Harvest ETF, an exchange-traded fund tracking cannabis companies, rose by as much as 21% to its highest level on Monday. It’s still down more than 90% from its 2021 peak.

(Updates to add Trump comments starting in second paragraph.)